| |||||||

| |||||||

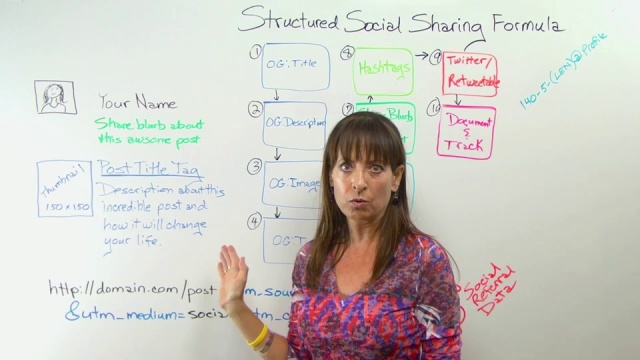

Structured Social Sharing Formula - Whiteboard Friday |

| Structured Social Sharing Formula - Whiteboard Friday Posted: 13 Sep 2012 07:57 PM PDT Posted by Dana Lookadoo Sharing content via social media is simply the next step after hitting the "Publish" button. How do you ensure your shares on Facebook, Google+, and Twitter are optimized? With a little planning and coding, you can make them look their best so that they go viral and track effectiveness in analytics. In this Whiteboard Friday, Dana Lookadoo unpacks the Structured Social Sharing Formula (SSSF): 10 steps for optimizing Web pages and social shares. The process includes:

Keep an eye on the blog next week for a supplemental post from Dana offering detailed steps from her Community Speaker presentation at Mozcon 2012. To learn more about social markup and tagging, download the free Structured Social Sharing Formula!

8:30 Video Transcription

Video transcription by Speechpad.com Sign up for The Moz Top 10, a semimonthly mailer updating you on the top ten hottest pieces of SEO news, tips, and rad links uncovered by the Moz team. Think of it as your exclusive digest of stuff you don't have time to hunt down but want to read! |

| You are subscribed to email updates from SEOmoz Daily SEO Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

brightonSEO: Live Blog | |

| Posted: 14 Sep 2012 01:50 AM PDT Live from Brighton, and we’re really looking forward to hearing their insights and thoughts; all 19 of them! Doors opened at 9:00am and the first speaker is scheduled to speak at 10:00 am. Stay tuned. We don’t have fancy auto-refreshes so you’ll need to refresh your browser to see the updates :-) 10:01 am: The first speaker is on stage, Dave Trott – Executive Creative Director at CSTTG will be talking about “Predatory Thinking”. Sounds intriguing. Must be similar to “Guerilla Marketing”. Dave’s using an analogy of pure maths and applied math with pure creativity and applied creativity. Pure = theory, like the art you see in galleries, or poetry. Applied = practical, like advertising Dave suggests that, when it comes to creativity, we follow the essential Bauhaus principle – form follows function. In other words, everything we do needs to have a reason and try to solve a problem. Practical creativity is to ensure what we do is remembered. Everything we do sits, naturally, within the context of our industry. What you need to do is distinguish yourself and what you’re doing. Don’t blend into the background; you need to stand out. Predatory thinking is about getting ahead. Dave talked about three stages of advertising:

Most marketers focus far more on Persuasion than on anything else. However, it would be far more useful for them to focus on Impact. This is because most advertising, 90% in fact, isn’t remembered at all. It fails at the Impact stage. The key point here is that it doesn’t matter how persuasive you are if no-one remembers what you do. The problem is that people are over-exposed to advertising. This means that the have very selective perception when it comes to what they see. In fact, we are very binary. Ideas either stand out to us or they don’t. And if they don’t stand out then we simply forget about them.

So, in order to have Impact, you have to stand out. You have to be different in order to be remembered and so have any chance of success.

People are either opinion formers or opinion followers. There are, of course, far more opinion followers than opinion formers. You want to really engage with the opinion formers rather than opinion followers (particularly if you can't throw lots of money at your advertising and simply buy numbers) because they will disseminate the information and it will travel downwards to everyone else. This doesn’t happen if you’re only attracting opinion followers. To get opinion formers interested you have to stand out and be different. That's what they’re looking for.

Dave’s now talking about how to solve problems you can’t solve. He’s used several examples to show how to go about it. Here’s one: People used to have a lot of chip pan fires. No matter how much information people saw about the dangers of leaving chip pans unattended and how bad chip pan fires were, it didn’t change their behaviour. They looked at the effect this was having, and it was causing a huge number of fire brigade call-outs. So they changed the problem. They decided to try to minimise the number of fire brigade call-outs. So they started a campaign to teach people how to put out chip pan fires. This resulted in a drop in chip pan fires of 40%.

What predatory thinking is about it changing problems you can’t solve into ones you can. You’ve got to go upstream and work on a problem higher up. It’s all about getting ahead!

Another great example is the iPod. When Steve Jobs created it, he’d invented what was, at the time, the best way to listen to music on the go. And, it was picked up by the coolest people. However, the problem was that everyone who had one walked round with it in their pocket, so no-one knew they had it. So Steve thought outside the box. He went upstream and thought “How can we make everyone who has an iPod noticeable?” And what did he think up? Headphones. Everyone has to wear headphones and at the time everyone had identical, black ones. So he made iPod headphones white. Immediately, everyone who had an iPod became a walking advert for the product. Genius!

DO YOU SPEAK BRAND? Antony Mayfield SEOs like to be diva's where there's always talk about when search is going to be dead. There are adversarial dialogues between the different disciplines such as social vs SEO or Paid search vs. SEO etc. But people miss the opportunity of bringing all these elements together in order to create real value and real impact. The most powerful thing about search is that it's a database of insight in to consumer's intent. Lucky seven. Anthony explained how a woman used to be really fed up of searching for things like holidays or furniture and always getting the same, bland shops and results. So what she started doing was, when she'd done a search, go to page seven of the results and start looking there. She'd bypass all the optimised results and start with more random offbeat ones. Apologies for the infrequent updates folks. The wifi at the dome is pretty horrendous. I’m actually stood outside updating this post via 3G at the minute. It’s the first coffee break. So we’ll probably freshen up a bit and come back for more updates. © SEOptimise - Download our free business guide to blogging whitepaper and sign-up for the SEOptimise monthly newsletter. brightonSEO: Live Blog Related posts:

|

| You are subscribed to email updates from SEOptimise » blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

...then access to tools is no longer sufficient. Everyone you compete with has access to a camera, a keyboard, a guitar. Just because you know how to use a piece of software or a device doesn't mean that there isn't an amateur who's willing to do it for free, or an up and comer who's willing to do it for less.

...then saying "how dare you" is no longer a useful way to cajole the bride away from asking her friend to take pictures at the wedding, or the local non-profit to have a supporter typeset the gala's flyer or to keep a rock star from inviting volunteers on stage.

...then you ought to find and lead a tribe, build a base of people who want you, and only you, and are willing to pay for it.

...then you need to develop both skills and a reputation for those skills that make it clear to (enough) people that an amateur solution isn't nearly good enough, because you're that much better and worth that much more.

...then you should pick yourself and book yourself and publish yourself and stand up and do your work, and do it in a way for which there are no substitutes.

It's true, if someone wants professional work, then he will need to hire professionals. But it's also true that as amateurs are happy to do the work that professionals used to charge for, the best (and only) path to getting paid is to redefine the very nature of professional work.

Scarcity is a great thing for those that possess something that's scarce. But when scarcity goes away, you'll need more than that.

[You're getting this note because you subscribed to Seth Godin's blog.]

Don't want to get this email anymore? Click the link below to unsubscribe.

| Your requested content delivery powered by FeedBlitz, LLC, 9 Thoreau Way, Sudbury, MA 01776, USA. +1.978.776.9498 |

Mish's Global Economic Trend Analysis |

| Posted: 13 Sep 2012 01:02 PM PDT In my previous post Desperation Bazooka Tactics; Gold Soars Following Huge Headfake, I mentioned "This seems like desperation bazooka tactics. Specifically, the Fed is in a panic state over jobs." I am not the only one to come to that conclusion. Saxo Bank economist Steen Jakobsen sent out a post moments ago, FED Did Panic...... They are now doing 'open ended' bond buying - no finite time or amount...hence this will go down as QE Extreme.Congratulations to Steen for predicting this outcome today. On a podcast with Chris Martenson yesterday, both of us stated the Fed would not do much this month but would at some point panic. Well, panic the Fed did, and sooner rather than later. Mish Interview With Eric King Last evening, I had the pleasure of chatting with Eric King for about an hour regarding the state of the global economy and how central bankers would react. The results are on King World News in a post released today before the FOMC announcement: Global Economic Plunge, Money Creation & Soaring Gold Today Mish warned King World News that investors should prepare, "... for a big plunge in economic growth worldwide." Mish also said that despite the plunge in the global economy, "I expect to see gold breakout to the upside and I think we are starting to see that right now. The same thing is true for silver."Panic Over Jobs So what is Bernanke panicked about? One word: "jobs". If you want a second word it's "recession". I covered both aspects last Friday in "Yes Virginia, It's a Recession". Recession Numbers Second Consecutive MonthI am going to reiterate my belief that the household survey tends to lead and today's panic suggests the Fed believes that as well. Here are two key Household Survey figures.

Household Survey Data  click on chart for sharper image In the last year, the civilian population rose by 3,695,000. Yet the labor force only rose by 971,000. Those not in the labor force rose by 2,723,000 to yet another record high 88,921,000. That is an amazing "achievement" to say the least, and one that has the Fed in panic mode. Addendum: Note to All Facebook Users: If you have not yet voted for your favorite charity (it costs nothing to vote), please do so. Chase is giving away $5 million to charity, and I have a cause that I support. Please click on this this link: Facebook Users, I Have a Favor to Ask, then follow the instructions. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List Mike "Mish" Shedlock is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction. Visit http://www.sitkapacific.com/account_management.html to learn more about wealth management and capital preservation strategies of Sitka Pacific. |

| Desperation Bazooka Tactics; Gold Soars Following Huge Headfake Posted: 13 Sep 2012 10:23 AM PDT The Fed came out blazing today with desperation bazooka tactics, not that it will matter one iota to jobs or housing (because it won't). Specifically, the Fed announced it would ...

Please consider a few snips from the FOMC Official Press Release. To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee's holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.Desperation Bazooka Tactics This seems like desperation bazooka tactics. Specifically, the Fed is in a panic state over jobs. It also leaves me wondering, if this does not work (and it won't), what else can the Fed do? Promise to hold rates low forever? Buy every treasury and agency? Gold's Response After the market makers cleared every stop to the downside, gold blasted higher.  That is one hell of a downside headfake, to the tune of $40, after which gold moved $75 in the other direction. US Dollar's Response  Curiously, the US dollar barely budged in comparison, but is heading lower after initial wild gyrations in both directions. In contrast, gold never looked back following the initial and certainly unwarranted $40 drop. Addendum: Note to All Facebook Users: If you have not yet voted for your favorite charity (it costs nothing to vote), please do so. Chase is giving away $5 million to charity, and I have a cause that I support. Please click on this this link: Facebook Users, I Have a Favor to Ask, then follow the instructions. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List Mike "Mish" Shedlock is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction. Visit http://www.sitkapacific.com/account_management.html to learn more about wealth management and capital preservation strategies of Sitka Pacific. |

| Posted: 13 Sep 2012 01:07 AM PDT A collapse of property schemes, commodity schemes, and other investments schemes in China is well underway. The Ponzi schemes all had one thing in common: they needed an ever-growing pool of suckers to pay the returns promised to investors. Well, the pool of greater fools finally ran out, and Shadow Bankers Vanished Leaving China Victims Seeing Scams China's slowest economic growth in three years and a slumping property market, where many so-called shadow-banking investments are parked, are squeezing millions of Chinese who have invested the money of friends and acquaintances chasing higher yields to honor those payments. The slowdown also is putting pressure on the government to rein in private lending to avoid a spate of defaults that could increase the number of victims and lead to social unrest.Implosion Reaches Critical Mass China's shadow banking is not a new topic, and the implosion now appears to have reached critical mass. Here are a few more Bloomberg articles. China Shadow Bankers Go Online as Peer-to-Peer Sites Boom China Slowdown Stymies Plan to Curb Shadow-Banking Risks China's Top Court Suspends Death Sentence for 'Rich Sister' Wu Shadow Banks on Trial as China's Rich Sister Faces Death China Credit Squeeze Prompts Suicides China to 'Strictly Control' Shadow Banking Risks, Liu Says Addendum: Note to All Facebook Users: If you have not yet voted for your favorite charity (it costs nothing to vote), please do so. Chase is giving away $5 million to charity, and I have a cause that I support. Please click on this this link: Facebook Users, I Have a Favor to Ask, then follow the instructions. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List Mike "Mish" Shedlock is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction. Visit http://www.sitkapacific.com/account_management.html to learn more about wealth management and capital preservation strategies of Sitka Pacific. |

| You are subscribed to email updates from Mish's Global Economic Trend Analysis To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |