SEOptimise |

| Posted: 21 Oct 2011 03:45 AM PDT

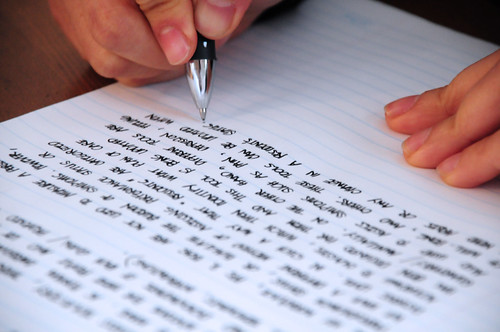

Here at SEOptimise we've been thinking a lot about copywriting recently. More than usual, that is! As the person responsible for overseeing copywriting at SEOptimise, I thought I'd share a few thoughts on the frankly quite lamentable state of what has become known as "SEO copywriting". Any copywriter worth their salt will doubtless share my opinion that so-called "SEO copywriting" gives the world of copywriting a bad name. Despite using the name "copywriting", it couldn't be further from this highly skilled profession. As we all know, this lesser species of copywriting has evolved because once upon a time, it was considered acceptable to throw together a quick article on "the secret to cheap international calls" or whatever, and submit it to a dozen or so article directories for a few quick links. But Google quite rightly recognised that that kind of rubbish was not remotely helpful to its users, and has been banging on about high-quality content with renewed vigour ever since. In the light of the Panda update we made the conscious decision, as an agency, that the content we produce for our clients during the course of routine link building activities would have to take a big step up from the typical article directory fodder which has unfortunately come to be associated with the SEO world. Moving away from devalued article directories, it becomes necessary to intensify link building efforts in other areas; guest blogging is one area which immediately springs to mind, and one in which we have been met with considerable success for most of, if not all, our clients. But for this strategy to be successful, and to gain good links from high-authority blogs which have a high readership, it's necessary to produce decent pieces of writing that bloggers will actually want to feature. It's just a shame that a lot of professional copywriting services seem to be stuck in the past when it comes to churning out the kind of copy regularly to be seen gracing the spammier article directories. Haven't they heard of the Panda update? Don't they realise that this sort of crappy copy doesn't cut it anymore? In the past, we've been through a string of copywriting services and the blog posts we've had written have been very much of the article directory ilk – ill-thought-out, boring and, I might add, riddled with typos and fundamental grammatical errors. If you've read my previous posts or if you follow me on Twitter, you may remember that I take a dim view of poor grammar, so you can imagine my reaction to finding it in the work of professional copywriters. I also recently completed a Diploma in Copywriting, and the course material for that wasn't much better. A woeful state of affairs! At SEOptimise our rationale is that investing more in copywriting ultimately pays dividends. An interesting, insightful piece of writing that takes an original look at a topic will quite simply do far better for your SEO efforts than the sort of lazily spun "how to" articles churned out by "content generation" companies. Not only will you have far greater success in publishing the work on decent sites, but you'll also find that it's far more likely to be shared in the social media networks and you'll reach a much bigger audience. And more exposure means more links! To use a buzzword that I'm not altogether fond of (I don't like buzzwords either), it's pretty much a win-win situation! So I would argue that it's time for a rethink of how we – the SEO community – view copywriting. Rather than thinking of it as "SEO copywriting" or "content generation", our focus needs almost to shift back to a more traditional, journalistic approach to writing, with the emphasis on tackling new subjects, providing readers with meaningful insights and embracing the limitless possibilities of the English language beyond the narrow confines of article directory spam. And on that note, if you'd like to write full time for SEOptimise, we're currently expanding our copywriting team: check out our copywriter job vacancy for more details. Image credit: jjpacres on Flickr. © SEOptimise - Download our free business guide to blogging whitepaper and sign-up for the SEOptimise monthly newsletter. Redefining "SEO Copywriting" Related posts: |

| You are subscribed to email updates from SEOptimise » blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |