Posted by number1george

This post was originally in YOUmoz, and was promoted to the main blog because it provides great value and interest to our community. The author's views are entirely his or her own and may not reflect the views of SEOmoz, Inc.

As you probably noticed, last week Google did a pretty big makeover of its local search results page, incorporating the local results directly within the organic results. In some cases it appeared that the old “7-Pack” was just given larger real estate on the SERP. In others, it just looked like the websites were just given links to their Places page. And sometimes, it just looked like an entirely new SERP, different than both the original organic rankings and the lettered, local results. But what was the real effect this change had on local search results?

How I Got My Data

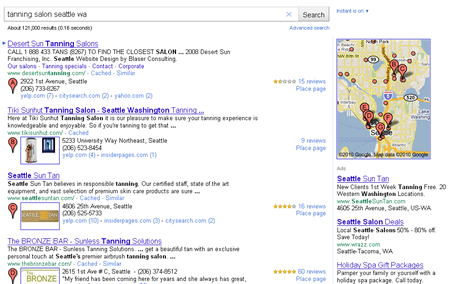

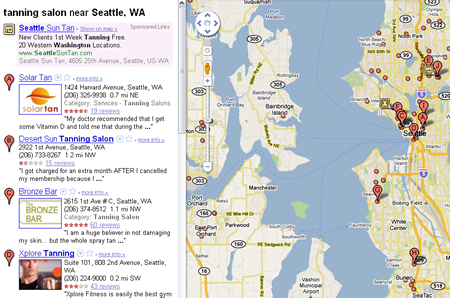

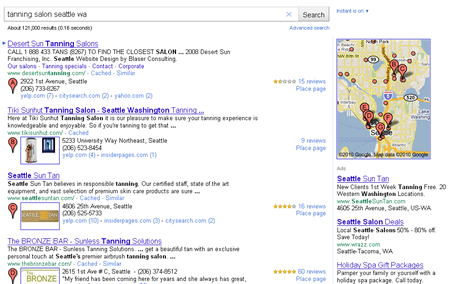

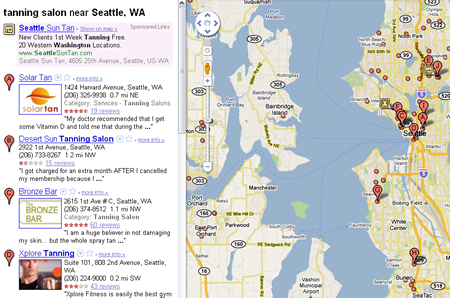

Visually, the new local search results page includes information from the both website and the business's Places page. The title and description are taken from the website but select information from the Places page is also included as well as a direct link to the Places page in Maps. Here we see an example of a search for "tanning salon seattle wa" and how the combined results are displayed.

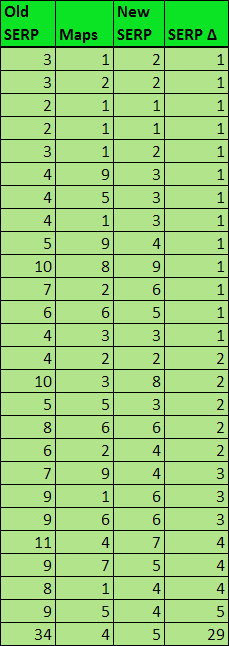

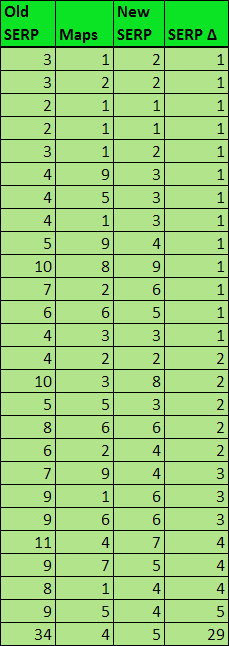

To find out the effects of combining the results, I grabbed the rankings of 50 somewhat random websites we’ve been tracking. As an initial criteria, I tried to use sites we’d been tracking for at least 2 months. I also eliminated sites with substantial fluctuations in their rankings within the prior few weeks since there would be no way to attribute those changes to any particular factor. Lastly, though I originally intended to use a completely random sampling, I eventually skipped over several sites that had no change since several of these were in non-competitive areas where they pretty much dominated all other websites for their searches.

After I had my sample, I did some quick research, comparing the organic rankings of several websites prior to the change to their rankings after the change. I then performed the same search in Google Maps in order to determine how their Places pages were ranking individually.

With a few exceptions, the top 7 ranked results in Maps are what were displayed in the old 7-pack for the same search. These listings were ranked independently of the organic results beneath them. By comparing their former organic ranking to their current organic ranking, I was able to see if a change could be correlated to their Places page's ranking in Maps.

So, Was There Any Change?

Of the 50 websites examined, 30 of them had an improvement in the new, “combined” results while 6 of them dropped. In most cases, this shift in their ranking could definitely be attributed to the performance of their local listings.

The Good

First, let’s look at the ones that improved. I did eliminate 4 outliers but, for the most part, you can see a direct correlation between the sites’ improved ranking and their local ranking in Maps. Obviously, I can’t publish any actual websites or keyword searches, but the searches all used a typical local query consisting of “business/service city st”.

Generally, it can be said that sites performing well in both organic and local perform even better in the new consolidated SERP. In several cases you can directly see how a well-performing Google Places listing now pulls up your organic ranking.

In some instances, the combined performance of a business with both a decently ranking website and Places page was enough to push it up a rank or two in the new results. In others, it appears that a well-optimized Places page was able to significantly improve a decently performing website and increase its ranking by several spots. Basically, your local listing’s performance appears to be a significant ranking factor in the new organic results.

The Bad

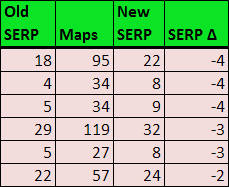

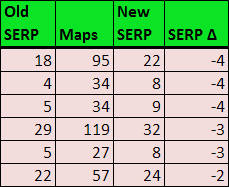

Since a business’s local listing has the ability to positively affect its website’s performance organic results, let’s look at the ones that dropped in ranking to determine if there is a negative factor associated with the new SERP.

First, the fact that the sample size I was able to obtain was so small already implies that a poorly performing business listing doesn’t seem to have much of an effect on a website’s performance. Looking at the original rankings, you can also see that 3 of these sites weren’t doing that great to begin with. In fact, it would probably be fair to assume that their drop was due to an already negative trend. But what about the websites that were doing well but dropped after the update?

Digging deeper into these, I soon discovered that this wasn’t really a direct result of the poorly performing business listings dragging the websites down, but rather that, due to the local results being buried so deep in Maps, Google didn’t associate a business’s Places page with their website. As a result, other websites that did have strong Places pages were ranking higher. So, while having a poorly ranked local listing didn’t penalize the website, it was a whole category of optimization that the website was lacking. Almost like having a great inbound linking strategy but no content structure.

Other Observations

While going through dozens of various local searches, there were a few things that stood out:

- Directory listings appear to be showing up more frequently in local results, in some cases taking up the top 3 spots in results.

- The 7-Pack, or rather one-line business listings similar to the old 7-Pack, aren’t gone entirely. Lettered results still tend to show up when Google isn’t entirely sure you’re trying to do a local search. Typically, this happens in searches for smaller cities or regions.

- When using rank-checking tools, the one-lined, lettered listings won’t be counted - just like before. The larger results being discussed here, however, are treated just as normal organic results prior to the change, completely disregarding the letter and local information assigned to it.

- Lastly, while I encountered plenty of websites on the first page without a Places page, I encountered very few Places page ranking on the first page without a website. Prior to the change, it was not uncommon to regularly see local listings with no associated website ranking in the 7-pack. Now it appears that, without a website, it is nearly impossible to be in the first page of Google’s general SERP for most searches.

What Does This Mean?

So what can we learn from all this? Basically, it’s just what Google said all along - everything is important. Your best bet is to have both a terrifically optimized website and an optimized, claimed Places page to associate with it.

Not only does Google seem to use a Places page as an organic ranking factor, but having one also gives you nearly twice the real estate devoted to your business in the results. Instead of just having a few words in your title tag and meta description to sell your business, you now have your address, phone number, reviews, lists of other websites that mention you, and even a picture to draw attention to your website.

Bottom line: all those old debates about whether it was better to have the top-ranking website in organic or have your business at the top of the 7-pack are over. Even if this isn’t the final layout, it’s clear that Google intends to make both count.

Do you like this post? Yes No