Gaming Social Media Signals For Fun And Profit |

| Gaming Social Media Signals For Fun And Profit Posted: 21 Nov 2011 12:52 PM PST Posted by joehall This post was originally in YOUmoz, and was promoted to the main blog because it provides great value and interest to our community. The author's views are entirely his or her own and may not reflect the views of SEOmoz, Inc. About two weeks ago I gave a talk at Pubcon titled, "Global Social Media Signals For SEO". During the end of the talk I briefly mentioned several techniques used to "game" social signals. Afterwards it was apparent that many were interested to learn more about gaming these signals. So without further ado, I would like to talk more about how to game social media signals. Oh wait a second! It looks like I got a little ahead of myself, before we go any further I think we should try to answer one question: Why should anyone try to game social media signals? If you are a giant dork (like moi), then gaming social media signals can be fun! However, if you have friends in the real world then I would suggest you try and identify actionable goals with the signals you are gaming, otherwise this might turn into a waste of time. Some actionable goals would be to push content with in networks, increase user "authority", or even game outside channels like search results. Quick note about, gaming search results with social signals: Social media signals for search are still in its infancy. Over the last several years we have seen the engines employ a variety of different techniques to integrate social signals. However, each of these have had fluctuating significance. Therefore, I would advise that you integrate social signals as a part of a much larger marketing plan that also includes all of the fundamentals of SEO. Social media is not replacing SEO, it's making it better. Get Inside Your Target's Head (psychology)Your target here is your audience, and it's important that you understand what they are motivated by to get them to act. Most economists will call these "incentives". However, most of the time we aren't using direct calls to action in social media, so these are more likely akin to dangling a worm in-front of a fish. We aren't telling the fish to bite; we are hoping that the worm looks good enough for the fish to bite on its own. A much more recent study [PDF] published by the Journal of Marketing Research looked at what types of content are more likely to go "viral". They concluded that content that invoked high physiological arousal was more likely to be shared or engaged. Leveraging The Right Content While images are ruling Facebook, animated images are killing it on Google+. Some of you might find them annoying, but it has become increasingly apparent that these zany GIFs are very popular with "shares" and "+1"'s. Just a few days ago I got over 200 shares in less than 12 hours with an animated GIF. Check out GIFBin and browse the top rated or top tagged for animated GIFs that will work well with in Google+. If blog posts are your cup of tea, you should learn to embed viral factors to increase on page sharing. Things like uniform image sizes and emphasizing white space can motivate more social clicks. Images (both animated and not) can get a lot of traction, but other content types can be just as successful. The trick is finding (or creating) what works. What I typically do is troll other networks like reddit or digg looking for content that is already trending. Then I re-post on other networks. I used to call this "Retweet Bait", but it can be applied anywhere that inner-network sharing is available. Identifying The Right Signals

Share/Spread Signals - Gaming these signals can help not only distribute content to the widest audience, but will also put your name in-front of other users, increasing relationship metrics and improving authority. If you are a "breaking" news publisher you are going to want to focus on these metrics to influence Google's recent freshness update and trip the query deserves freshness signal. For best results you are going to want to use clear straightforward calls to action like, please retweet, "please share", or any other appropriate variant. Simple Quantitative Signals - These have got to be the simplest social signals available. They are great for measuring content quality and act as a baseline for other metrics. You can easily game these by including clear straight forward calls to action. "Please support us by liking this post!" If you are using WordPress, you are going to want to check out the WP Greet Box it allows you to include a custom call to action above or below the post based on the referring URL. So if a user comes to your blog from Google+ you can include a call to action similar to: "Hey there! If you enjoy this post please +1 it!" Authority Signals - Search engines and social networks are constantly trying to judge authority. These signals are vital to having strength in social media. The most obvious authority metric is relationship ratios on asymmetrical networks like Twitter. With asymmetrical networks we can judge authority [PDF via] by looking at the ratio to following and followers. Facebook recently added the subscribe feature which will give the ability to use this same type of analysis. Authority can also be weighted by inter-network mentions and even inbound activity. Discussion Signals - When users comment on your content they are effectively sending a signal that your content holds value. Content that starts dialog generally also gets shared. To game this signal you are going to want to ask open-ended questions that inspire debate or dialog. Make The Signals Pop

While EdgeRank is exclusive to Facebook, other networks have similar systems of ranking internal content. It is clear that Google+ is using something analogous to EdgeRank, but with two main differences: Google+ doesn't filter content in the social stream, it just reorders it. Also, it appears that Google+ doesn't put as much weight on affinity as Facebook does. Kitchen Sink StrategyIn marketing (and life) I often execute what I call the kitchen sink strategy. Basically this entails throwing "everything but the kitchen sink" at a problem and seeing what works. Gaming social signals are no different. Which is why when I promote content I try to include as many of the tactics described above as possible. For example, not long ago we launched a small site to test various marketing strategies. When it came time to test Google+ I wanted to attack the signals from all corners. Therefore, I embedded the OpenGraph image meta tag to pull a large version of our logo into the social stream. Then I designed a question with direct calls to action embedded into multiple choice answers. Coaxing the user to engage with multiple choice questions is an example of manipulating inherent cognitive biases. The result? We get basic feedback about a design and gamed Google+'s social stream with all the elements needed to make the signals "pop". Keep Pushing The LimitsSocial media signals are gaining significance every day. However, as information sharing changes and the various social channels rise and fall in popularity, there is no set methodology you should follow now or in the future. Instead, it is important to constantly test new strategies and ideas. Good luck gaming! | ||||

| Yahoo Sunsets Site Explorer (A Eulogy) Posted: 21 Nov 2011 12:39 AM PST Posted by iPullRank Bing, Yahoo!, members of the Microsoft family, Tim, distinguished guests, inbound marketers and fellow Mozzers today we say goodbye to competitive link intelligence as offered by one of the Big 3 Search Engines. The SEO world will remember the brainchild of Tim Mayer, Yahoo! Site Explorer, as the first comprehensive tool that allowed users to find out which sites and pages were indexed, inbound links to any site and submit and track XML feeds. Yahoo, the search engine that could -- and did invent the precursor to not only Bing and Google’s Webmaster Tools but also link indices such as LinkScape/Open Site Explorer and MajesticSEO. Yahoo Site Explorer was born September 29th, 2005 and has been laid to rest November 21st, 2011; you had an amazing run. Yahoo! Site Explorer or YSE as you were known to those closest to you, we will remember your sleek easy to use “Don’t Make Me Think” user interface. It was very clear what you wanted us to do and once we did it you generously shared your data with us as though we were family. You asked no questions of us unless of course we were trying to change your mind. Only then did you require us to prove ourselves. We will remember you for allowing us to submit feeds, URLs, sitemaps to “Tell us what we don’t know. If you don’t find a URL that you expect to be in the index, use free submit. In case you hadn’t heard, we are also accepting lists of URLs, so you don’t have to provide us one URL at a time” as Yahoo! declared at your birth. YSE we will remember you for charming ability to show us more about ourselves and where we could improve to be better in the eyes of the Internet. You shared what information you knew about us almost as fast as you could collect it. YSE we will remember you for your special ability to tell us about everyone else that knew about us and where they’d shared it on the web, before you there was no comprehensive way to do that. Sure Google had the “link:” operator but it was never as forthcoming as you were. Most importantly YSE we will remember you for telling us who linked to our competitors. This is how you truly changed the world. We respect you and commend for all your efforts and the API that once fed a variety of tools such as BackLinkWatch and the SEOBook Link Tool Suite. Your knowledge, speed and freshness will be missed. Many Search Marketers will pause and reflect on Yahoo Site Explorer with feelings of inspiration and serenity:“Y!SE was the inspiration for me to raise capital and build the Linkscape index w/ Nick+Ben. I felt the web's link graph should be a resource that's available to anyone, and that's why we always made sure that users of OSE could get the same functionality Y!SE offered for free (up to 1,000 links, unlimited runs, etc.)” - Rand Fishkin (CEO & Co-Founder of SEOmoz) “YahooSiteExplorer, to me, has become like a well-loved piece of furniture, think Grandma's old couch, that served its purpose at one point, but now sits forgotten in the parlor. Much like Grandma's old couch, I have not used it much in the past year, since I have had full access to OpenSiteExplorer and MajesticSEO, but YahooSiteExplorer will always be remembered fondly." –John Doherty “Feels like I'm one of the few that will miss it! I used to love some of the combinations of operators you could use on it” - Paddy Moogan “cos 'All good things are wild, and free' - Henry David” –Himanshu Sharma "Free backlink research on your competitors will never be the same" – Dennis Goedegebuure “YSE was simple to use and a great way to find links to competitors other tools might miss.” –Joe Youngblood "I 'grew up' with it as an SEO, had a nice little link from my desktop, was easy and convenient to access." – Carla Marshall “No alternative is as fast as YSE. Gone are the days of same-week link reports. We'll have to get smarter (as always in SEO).” - Tre Jones “I will miss it because it was a very fast way to see if a link was there. And because it was my 1st SEO tool (with other)” –Gianluca Fiorelli "Even after I switched to OSE for everyday use, it was always strangely comforting to know that YSE was there. It was kind of like that friend you rarely talk to, but you know will be on the other end of the phone if you need them." -Dr. Pete While others will dance on your grave and celebrate your death:“YSE was an inspired flank-attack by Yahoo on Google at the time and was the SEO tool of choice for years. But its time has come.” - Dixon Jones (Marketing Director of MajesticSEO) “I actually won't miss it! Sorry YSE!, it was good while it lasted.” –Richard Baxter “I won't miss YSE. There's really been little to no value in site explorer since Yahoo gave up on being a search engine.” –Bill Slawski “I won't miss it, it was a brain melt of information with no logical organisation. There are plenty of tools that give better data” –Wayne Barker “I agree with Bill Slawski I quit using YSE 2 years ago.” –Joe Hall However no one can deny that you’ve changed the game and gave birth to variety of children that have continued to walk in your large footprints. Save for Blekko, no search engine offers the transparency that you did YSE. And while some third party tools have surpassed you in presentation, metrics and breadth of data most are still attempting to attain your speed, freshness and accuracy. Although via the Bing-Yahoo! alliance Bing Webmaster Tools is your named successor Open Site Explorer and MajesticSEO clearly lead the pack with their extensive link indices and in-depth analysis of that link graph only time will tell which of your offspring will emerge victorious as the king of backlink analysis.

The Creator in his Own WordsI've asked Tim Mayer, the father of Yahoo Site Explorer to say a few words about his about his brainchild, particularly about how it came about, the pitfalls, how he feels it was handled and the future. Without further ado I give you Tim in his own words: "There were a few reasons for launching site explorer in no particular order:

The need was that webmasters needed to know who was linking to them, which of these links were being recognized by the search engines as well as how many and what pages were being indexed by the search engines. There were not many pitfalls as I saw them and it became a popular tool for many people. I am sure some SEOs such as Dave Naylor, Greg Boser and Rae can give you some pitfalls... I feel it was handled well [by Yahoo! after I left] for a while. Now Yahoo is no longer an algorithmic engine and the responsibilities to engage and interact with the webmasters and publishers has now become the responsibility of Bing. I have had the opportunity to spend some time with Duane Forrester at Bing and he is a great interface for the webmaster community for Bing. Google has always done a great job interfacing with the webmaster community via people like Matt Cutts, Vanessa Fox and Mail Ohye. It was fun working with them on standards such as open site maps. We also developed some webmaster features of our own such as NOODP and NOYDIR tags to opt out of using directory data in the search engine title and descriptions. I think it is awesome that others have created similar tools such as Majestic and SEOMOZ [Open Site Explorer]. I am always very excited when people come up with upgraded features that site explorer did not have such as when Majestic came out with historical link data which is so cool. I have always been interested in this space having launched a very basic product called URL Investigator when I was at FAST/All The Web in March 2003 then Site Explorer in September 2005. It is important for search engines to focus on the users but also to interface with webmasters and publishers as well. I feel that there are a lot of great tools in the space. I do see a lot of opportunity for these tools to improve and progress in the future as well. For the last year I have been in the Paid Search space working for Trada, a company in Boulder, Colorado. I left Trada the week prior to Pubcon and have been working on a new product. There are a lot of new marketing channels which are causing fragmentation to occur. These new channels are often influencing one another such as social's influence on search which will become more influential in the future. These shifts bring tremendous opportunity for someone with my passions and experience." Thank you Tim for you and your teams hard work and Yahoo Site Explorer, thank you for everything you shared with us and may you rest in pixels. |

| You are subscribed to email updates from SEOmoz Daily SEO Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

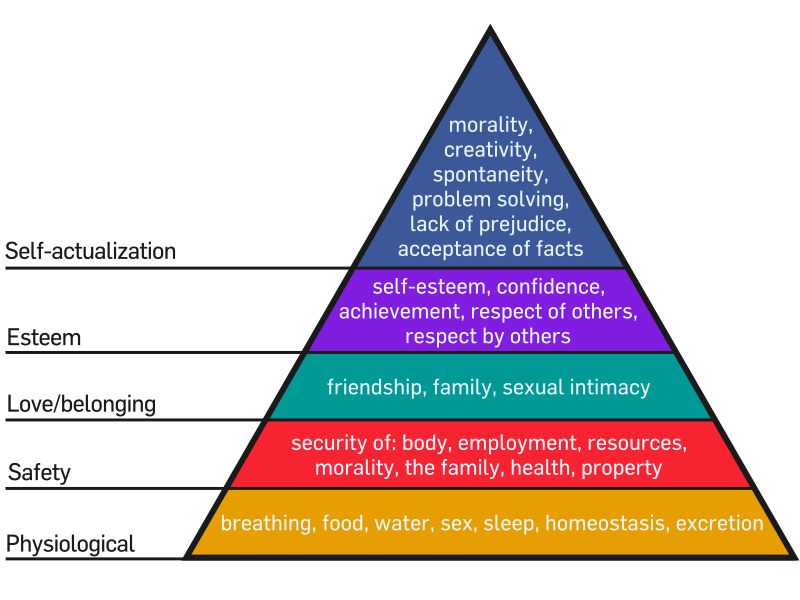

One of the most well known psychologists of the 20th century on the topic of motivation was Abraham Maslow. Maslow is widely known for his "

One of the most well known psychologists of the 20th century on the topic of motivation was Abraham Maslow. Maslow is widely known for his " Recently Matt McGee

Recently Matt McGee  Getting a handful of Facebook likes or +1's can be a good start. But to see real traction you have to make the signals "pop". It's hard to tell exactly what is needed to get each signal to register on the various networks, but one starting place is taking a second look at Facebook's

Getting a handful of Facebook likes or +1's can be a good start. But to see real traction you have to make the signals "pop". It's hard to tell exactly what is needed to get each signal to register on the various networks, but one starting place is taking a second look at Facebook's