Competitor Analysis and Benchmarking With the New Domain and Page Authorities |

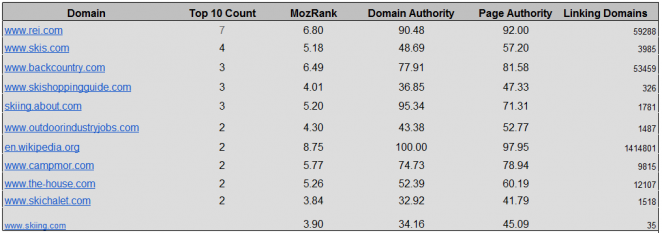

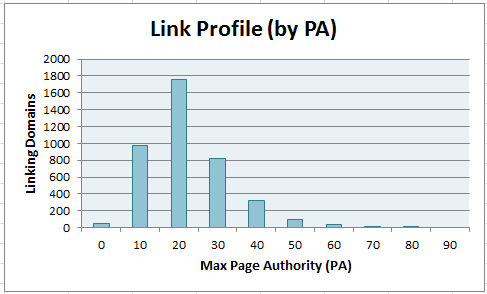

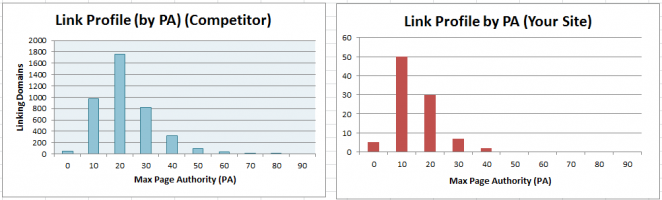

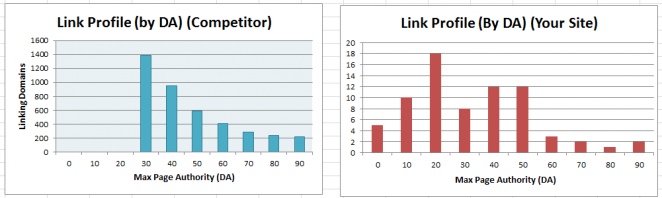

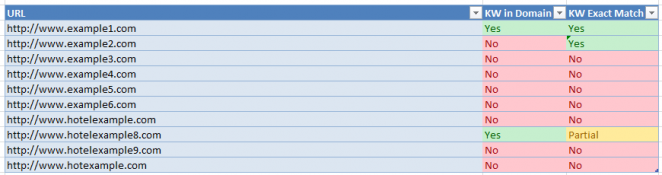

| Competitor Analysis and Benchmarking With the New Domain and Page Authorities Posted: 04 Dec 2011 12:48 PM PST Posted by dohertyjf As we all read last week, SEOmoz has released the second Linkscape index update of November, and with that came updated Domain Authority and Page Authority. Many of you probably noticed a change, either as a result of the broader crawl, or as a result of active linkbuilding you have been doing on your site or client sites. The purpose of this post is to help us orientate ourselves around what our scores mean and how those might compare to other sites that we are aware of. Remember, Domain Authority and Page Authority are strictly link based, so the metrics can be influenced by either more links from more sites, or a few links from higher quality sites. One should remember, however, that Domain Authority and Page Authority are hard to directly influence, as they are a combination of 30+ data points and work on a logarithmic scale. As Matt Peters noted in his blog post called "Introducing SEOmoz's Updated Page Authority and Domain Authority": Page and Domain Authority are machine learning ranking models that predict the likelihood of a single page or domain to rank in search results, regardless of page content. Their input is the 41 link metrics available in our Linkscape URL Metrics API call and their output is a score on a scale from 1 to 100. They are keyword agnostic because they do not use any information about the page content. What I want to do here is provide you a framework through which to benchmark your site against others in your niche. I'm going to take a mashup of tools that are already available so that you can go forth and figure out if you have any new competitors in your SERPs (Search Engine Results Pages). Then you can go forward and dig deeper into those sites in your own way to decide how to beat them. Let's go! Where Do I Start?The first step to take is deciding which keywords you want to rank for. For the sake of a more complete view of your market's landscape and SERP competitors, I recommend finding at least 20 keywords that would be very valuable for you. I've taken fewer for the sake of brevity, so here are the keywords I am going to be using for this example: First Tool - Tom Anthony's Competitive Analysis ToolSome months ago Tom Anthony, one of our London SEO consultants (who grows a wicked mustache, by the way), dropped a tool that he says can help you do competitive analysis in under 60 seconds with the SEOmoz API. Take your keywords and plug them into the tool. You will receive rows of data on your competitors and will be able to see how your site lines up. For the keywords above, this is the data that we see in the sheet: Full disclosure: I have no affiliation with any of the sites listed above, other than I buy from some of them periodically. Note - you will need to make a copy of it and get your own SEOmoz API key in order for this to work for you. Full directions on how to set up the sheet are available on the original post as well. What is important to get out of this list is the list of competitors. From the data provided as well, you can see relatively where your site stands for the search results (or by simply including your site at the bottom of the list and enlarging the sheet to include your metrics as well). Using the above metrics, if I was doing SEO for skichalet.com, I can see that my competitors to beat directly above me are the-house and Cabelas, but really I am gunning for Backcountry.com and REI.com, and I want to know how they are winning. Let's take this a step further and see why our competitors have a higher Page Authority or Domain Authority. PA Correlation (thanks to Dr Pete)Now that you have your competitor's DA and PA, and know roughly where you stand compared to them, you can begin to dissect why their PA or DA is so high. Remember, your metrics can be improved by either a) more links from more sites, or b) a few links from more authoritative sites. If you want to know why your competitor is beating you, I recommend using the spreadsheet in this awesome post about Link Profiling with OpenSiteExplorer. This sheet is useful because, according to Matt Peters, Page Authority is the highest correlated metric against a page's ability to rank well (from a link perspective). This sheet will give you a graph of the average Page Authorities of the sites linking to your competitors. After you have taken the data dump from OSE and plugged it into (LINK) the sheet, you will get a graph that looks like this: If you want to see your competitors distribution compared with yours, use this sheet, which will show you the two side-by-side like so: Using this, you can see that while your spread may be similar, the competitor on the left has many more linking root domains (the scale is much broader). That's where you need to start. DA CorrelationYou may also find it helpful to see the overall strength of the sites from which your competitors are getting links and the spread of those Domain Authorities across their backlink profile. For this purpose, I built a spreadsheet based off the PA Tool from Dr Pete above. The steps are exactly the same, but instead of the Page Authority graph you receive the Domain Authority graph: Right here you may come up against a shortcoming of OSE, in that with sites that have a lot of linking root domains you may not be able to get the lower DA links. So watch out for this. You can grab the Domain Authority Sheet right here. Final Secret Sauce - SERP Analysis Report + ExcelFinally, now that you have gotten a quick overall look at your competitors and know where you stand and what certain domain and page authorities mean for ranking in your niche, you'll want to make this actionable. The above graphs do not go specific enough to be very actionable, so now let's use the SERP Analysis Report (available in the Keyword Difficulty Tool) to put the data for your specific keywords individually (that you used at the beginning to begin finding your SERP competitors) A while back I presented a spreadsheet that allows you to take the SEOmoz SERP Analysis Report and dump it into an Excel sheet, which then gives you a bunch of graphs showing you where your site is weak. I'd be remiss to not say that I took this idea from Jason over at BusinessHut who gave away the original spreadsheet before the SERP Analysis Tool existed. You can read the full explanation of this sheet over at my site in the post called Making SEOmoz's SERP Analysis Tool More Awesome, but essentially what you can do with this sheet is:

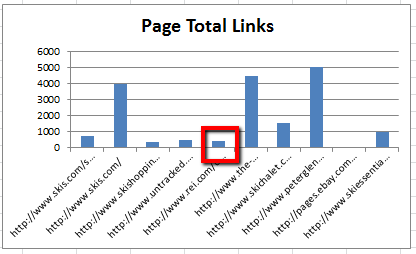

Maybe you'll find that your overall number of linking root domains is way low compared to the others in your SERP: Or maybe you'll see that your on-page targeting is off (which is great since DA and PA are only links based. Now you get a better site picture): Get the spreadsheet here. I hope this post has been helpful for you in finding where you compare against your competitors. Knowing approximately what the benchmarks are for your niche can really help with speedy link prospecting and qualifying your site against others. For those of you who are interested, here are some popular sites and their Domain Authorities, just for a quick snapshot of the web at large:

Websites taken from Rob Ousbey's post and the Getstat Codex. |

| You are subscribed to email updates from SEOmoz Daily SEO Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

“Gianluca Fiorelli” is one of the amazing and helpful celebrities in the list of Search Experts and an active Mozzer with the Rank ‘#3’ which trust me is hard to get and maintain!

“Gianluca Fiorelli” is one of the amazing and helpful celebrities in the list of Search Experts and an active Mozzer with the Rank ‘#3’ which trust me is hard to get and maintain!