Moz's $18 Million Venture Financing: Our Story, Metrics and Future |

- Moz's $18 Million Venture Financing: Our Story, Metrics and Future

- The Real Impact of the Google SmartPhone Crawler (Part 2): Generating Mobile Redirects Properly

- Gathering More Data: Time to Take and Share the 2012 Industry Survey

| Moz's $18 Million Venture Financing: Our Story, Metrics and Future Posted: 30 Apr 2012 08:00 PM PDT Posted by randfish Today is a good day. Whether you're a Mozzer, a fan of what we've built, a Seattle-startup supporter or even tangentially involved in the field of web marketing, there's reason to celebrate. After 5 years of organic growth (from our initial funding in 2007) and two tough, failed attempts at financing (in 2009 and 2011), I'm excited to announce that SEOmoz has raised $18 million in venture capital from Foundry Group and Ignition Partners. Brad Feld from Foundry and Moz's COO, Sarah Bird will be joining the board as Gillian Muessig steps down to pursue new goals. Oh, and that chip on my shoulder about VCs is probably gonna shrink a bit. :-) You can find the official meme-based press release here. But, as our core values dictate, this post is going to be lengthy and extremely transparent about our progress to date, the financing process, our new investor, and the road ahead. I've broken these into the sections below:

SEOmoz's Past 5 Years of Metrics & GrowthIn February of 2007, we launched a collection of tools and resources for SEOs, hoping it would help bolster our traditional consulting practice. By the end of that year, it was responsible for nearly half our total revenue and Seattle's Ignition Partners and Curious Office, invested $1.1mm to help see the vision of software for professional SEOs grow. Two years later, we dropped consulting entirely to focus 100% of our efforts on PRO membership. Since then, our subscription product has grown tremendously and achieved exceptional traction. We've iterated massively on the orignal product with launches of the Linkscape web index in 2008, Open Site Explorer and our Pro Web App in 2010, the Mozbar for Firefox and Chrome, SERPs Analysis and more recently, too, with additions like Social Tracking, Branded Segmentation, Google Analytics integration, Universal SERPs tracking, and our new, much larger, Mozscape index. And our customers seem to have appreciated it: *As of April 2012, we're significantly ahead of budget for 2012, w/ a March revenue run rate of ~$19mm As you can see, our small Series A has carried us a long way. Out of necessity, we've been re-investing nearly all of the money we've made in the last half-decade back into growing the company. Below, you can see the progress of our subscription model over the last 6 months. *December's lower free trials (due to the holidays) means slower January growth I've talked a number of times about our subscription metrics here at SEOmoz, but given this fundraising, I know there may be additional interest and scrutiny, so I'll try to describe them with a bit more depth:

For an enterprise SaaS business, these metrics are fairly mediocre (well, the churn metrics anyway, the acquisition numbers would be phenomenal), but thankfully, we're not the typical enterprise model. Because we have very low costs for customer acquisition (we acquire ~85% of our customers using inbound marketing rather than paid channels), and very low COGS (no account management, sales people, or services costs), our model scales very nicely. You can see more detail about this in our funding slide deck, embedded in the next section. Traffic's been growing at a somewhat shocking pace, too. In the first 122 days of the year, SEOmoz + OpenSiteExplorer had 6.85 million visits: Our traffic from every source has been increasing dramatically. In comparison, the 122-day period from April 3rd - July 30th, 2011 had 4.46 million visits, a growth rate of 54%. Search engines have been sending more traffic, our email marketing efforts are getting better, social media sources are up dramatically, and referring links + branded/direct is up, too. The only traffic source that's remained relatively stable is RSS, which we suspect is due to more and more people replacing their RSS reader with socially-based referrals and apps. Looking at Moz in 2012, it would appear that we've got a healthy, growing business, but as you can see from the growth chart above, we'd predicted that our last few years of doubling subscription revenue would slow. This is largely due to capital constraints on the business. We couldn't make the technology, infrastructure, people or marketing investments we knew were needed to accelerate. That's precisely why, at our early February board meeting, we decided that despite our setbacks the previous summer, it was time to hit the road seeking venture investment for a third time. Our 2012 Funding Process & DeckOur board of directors meets quarterly to discuss the key issues facing the company and review the progress made in the prior three months. At our February meeting, each of our executive team members - Jamie from Marketing, Adam from Product, Sarah from Operations and Anthony from Engineering - expressed the sentiment that their teams could benefit from additional capital and that the time was right for a raise. Kelly Smith (of Curious Office, an observer on our board) and Michelle Goldberg (who represents Ingition) agreed. Unfortunately, that meant getting my weary, jaded head back into the funding world, something I'd been dreading since our last financing fell apart just after we signed a term sheet in August 2011. We strongly considered but ultimately rejected hiring bankers to help us run the deal process, and this was in large part due to my personal issues of confidence. It's hard to describe that feeling now, but I truly believed and feared that we'd once again spend months on road, pitching investors, and end in June or July with nothing to show for it again. Much of February was spent contacting investors, colleagues and entrepreneurs we knew and asking for help with introductions, positioning and the creation and review of a funding slide deck. You can see a modified version of that deck below:

Some of those calls and connections led to early interest from some big names in the later-stage industry (VCs who typically put $15-50mm into companies at Series C, D and above). Unfortunately, these started out with a familiar pattern - a call expressing interest, a request for data, upon receipt of that data, a deeper request for more data, repeat ad nauseum. We were just settling in for the tough reality of a long slog to reach that first offer we could leverage to start a process when I got on the phone with Brad. Brad Feld and Foundry GroupNearly every entrepreneur and person connected to the startup field knows of Brad Feld and Foundry Group through the exceptional reputation they've built. Brad's been named the most respected VC in the business, makes hilarious music parody videos, funds dozens of successful companies, co-founded Techstars, is a two-time entrepreneur himself, runs inhumanly long distances and sponsors lots of public bathrooms. He's a very awesome, very weird and very Mozzy guy. I liked Ben Huh's recent post about him best: I've been fortunate to have him on our board and he's helped us even before we took funding. In start-up lingo, he's my number one value add, even on a board studded with greatly helpful and wickedly smart people. The funny thing is, I would describe my interactions with Brad as slightly weird. Yup. Weird. Not in the creepy WTF? kind of way, but good, like whoa-I'm-being-transported-to-another-planet kinda way... ...He's unlike any VC I've ever met. When we got on the phone, I knew that A) Foundry almost always does early-stage deals and B) They almost never put more than $10mm into a deal and C) They hadn't asked us for any preliminary information or a deck. Thus, I was fairly certain that this call was purely advice-driven, though I hoped it would potentially lead to some helpful introductions. But, when I started the call asking for help, Brad stopped me. He said Foundry was interested in potentially leading the round themselves. My heart skipped a few beats, and we got into a conversation. How do I know Brad? Through three of the more unlikely sources imaginable: first, Brad + Seth had looked at SEOmoz briefly in our 2009 raise attempt, but, like a lot of others, passed at the time; second, through my blog post on failing to raise money (which Brad read and wrote about); and last, through my wife Geraldine, whose blog and tweets are apparently a topic of enjoyment between Brad and his wife Amy. Side note: Next time someone asks what Geraldine's blog monetization strategy is, I'm replying with "it already made $18mm, what more do you want?!" :-) The Saturday morning after that phone call, Brad wrote a post entitled "Don't Be Gunshy Because You Dealt with BucketHeads the Last Time Around." The Moz team was already enamored with Brad and working hard to keep our excitement in check. That post made it harder, and then this email (sent later that evening) made it 10X harder still: We sent in excess of 40 emails back and forth over the next 3 days. Included in that volley was an invitation to come to Boulder, Colorado to meet some of the companies he'd invested in, his partners at Foundry, and talk seriously about an investment. I also got to talk to T.A. McCann from Gist, Ben Huh from Cheezburger and Keith Smith from BigDoor, Brad's other investments in Seattle. Interesting side note: Many investors we've talked to over the years have told us to "talk to their CEOs." I almost always take those introductions and get on the phone, but VCs may not realize either A) how honest CEOs are with each other or B) what their CEOs actually think of them. Due to these, I've often heard recommendations that damn with faint praise or point out a lot of good reasons not to get involved. Brad's one of only a few exceptions. The reviews were unbelievably positive. So much so that it was hard to believe they were real. Each one brought up example after example of Brad putting the entrepreneur's interests ahead of his/Foundry's own, even when serious amounts of money were on the line. He may never have heard of TAGFEE until our conversations, but Brad lives those values in his personal and professional life with the same obsessesiveness that we do at Moz. On Friday March 16th at butt'o'clock in the morning, Sarah and I boarded a flight to Denver, rented a car and drove to Boulder. We had lunch with the crew from GNIP, another of Foundry's investments. They are clearly awesome dudes - the kind we'd love to work with (and the restaurant they took us to had the impossibly-hard-to-find cult beer, Pliny the Younger, in stock). The pattern of Brad's investment in very cool people was becoming clear. After lunch, we spent the afternoon meeting with the Foundry team. There's only 4 of them, because Brad doesn't believe in associates (I'll let him explain in a blog post at some point). Jason, Ryan, Seth and Brad were all surprisingly easy-going and their styles put at ease, too. It was a welcome change of pace from the usual hours spent in VC offices. After the meetings wrapped up, Brad took Sarah and I to dinner down the street at Oak. Within minutes of sitting down, he said (rough, from my memory): "I talked to the guys before we left the office; everyone wants to do this deal. We're in." Have you ever been in one of those situations where you want to get up, run around the room screaming and high-fiving everyone then order all the beer on the menu, but you have to stay cool and act like everything's normal? First world problem, indeed. :-) Luckily, 30 minutes later, I got up to "use the bathroom" and texted my wife. She wrote back in classic Geraldine fashion: Can I just say again how awesome it is being married to her? We finished dinner with Brad, grabbed froyo next door, walked around Boulder's promenade and went back to our hotel. The following afternoon, he emailed over deal terms, all of which looked good except the pre-money valuation (initially $70mm - we'd hoped for higher). I emailed back that we loved everything about the deal, but were seeking a slightly higher pre-money. Brad said he'd check with his team and get back to us Monday. Despite my illness, I headed out to a bar for Moz's help team manager's (Aaron Wheeler) birthday. On St. Patrick's day. The bar was packed to overflowing. I think I ordered a "whatever sounds good to you" from the bartender. The wall was lined with Montana-esque memorabilia and knick-knacks. Nearly a dozen mozzers crowded around a jam-packed booth. I looked down at my phone and saw this email from Brad. Cue me freaking out, standing up from the booth, screaming and possibly attempting to buy everyone in the bar a round of drinks (thankfully, Geraldine grabbed me before I did so as it would have been a very expensive proposition). That round of jumping around and high-fiving everyone I missed out on in Boulder came back that night. I hope that after reading this post, you can let that same crazy smile spread across your face and lift a glass of your favorite beverage to help us toast. :-) Looking back on this process with Foundry, the calendar is practically unbelievable. The time from the first phone call to an offer and agreement on deal terms was literally 8 days.

Now back in Seattle, we spoke to Michelle from Ignition and went to their Bellevue offices that Monday to pitch their partnership (using the deck you've seen above). The timeline was accelerated by an upcoming 2.5 week trip I had to Madrid, Munich, London, Boston, and San Francisco, but we made it work. When I left for Madrid on Wednesday, March 21st, we had already started the diligence process for our Series B. On the middle leg of that long trip, in Munich for SMX, I had the chance to share some exciting news with friends at a downtown pub: And somehow, Geraldine captured their reactions (and mine) with impeccable timing: I think Will Critchlow's face in this photo perfectly sums up how all of us at Moz are feeling about this event. This, of course, was followed by much drinking of German beer: The round formally closed on Monday, April 23rd, when funds were wired to our account. Sarah sent around a nice screencap: Prior to that, $2.17mm was our highest-ever account balance (we've been a bit more profitable than expected the last few months). I have to say that after years of aiming for investment to help us grow the business and, yes, to get some additional, external validation of our work, our model and our market, the transaction itself feels pretty good. But, perhaps stranger still, was a reflection on the funding I shared first with Geraldine, and then later in an email to Brad: It sounds cheesy or overly-sentimental to say, but it's the truth. The money is going to help us do amazing things, and it's going to mean we can do a lot more of them faster and at greater scale than we could have on our own. But money can come from a lot of places. There's only one seat on our board for a new investor and I'm more certain than I've ever been about anything in my long tenure with this company that he and Foundry are the right match for our special brand of startup. The Company Today and My Cofounder's New PathFor those interested in the VC world and the specific of the transaction, I'll try to provide some detail:

Following the transaction, here's how the ownership breakdown of SEOmoz looks (be sure to mentally place a ~ in front of numbers): As part of this round, Gillian and I had initially planned two somewhat unique moves. First, to take some "money off the table," meaning that we'd sell shares directly to the company and use some of the funding for personal capital. We had initially intended to have Gillian take ~$4mm and me take $1mm, but ran into a challenge around pricing. In order to fairly value "common" stock (which is what Gillian, myself and employees own), companies must undergo a 409A valuation by an external party. Ours came back valuing the common stock at $49mm (vs. $93mm for preferred). This low number is great for employee option grants and recruiting, but means that we'd be selling a lot of shares to reach those target numbers. Hence, we opted to take more minimal payouts now of ~$440,000 each, most of which is going into a fund for some family members' debt we've long wanted to pay off. In the future, we'll have the option to sell back more shares at future 409A valuation prices. The second move is more non-standard. When a new employee joins a startup, they usually receive stock options equivalent to some percent of the company's total ownership (if you're interested in learning more, I recommend this post from Dan Shapiro and this one from Tony Wright on the topic). For example, let's say John joined SEOmoz in January 2012 and received 1,000 stock options and we have a total of 1,000,000 shares. John has options equivalent to 0.1% of the company. In a normal fundraising round, everyone takes some "dilution" to make room for the new investors. If the new investors own, say, 20% of the company in the funding round, John's options now represent 0.08%. Gillian and I have always been passionate about three goals around SEOmoz:

Saying those are goals is one thing, but making tangible, visible moves to prove that commitment is harder. This is one of the few times we can show how serious we are about goal #3. Thus, we each sacrificed shares we owned to give back to each active employee at the company so they maintain their ownership percentage. In our example of John above, this would mean 0.02% of new stock options granted to him. I'm incredibly grateful to Gillian for helping to make not just this transaction and stock sacrifice possible, but for all the amazing support and effort she's devoted to the the company over the last decade. For those who don't know, Gillian founded the business that eventually became SEOmoz in 1981! That's more than three decades ago. For the first two, she was the sole propietor. After 2001, when I dropped out of school, we joined forces with Gillian as President for the next 6 years. In 2007, after our funding transaction from Ignition, she stepped out of a day-to-day operational role to contribute as a full-time evangelist and member of our board of directors. Today, she takes another step toward pursuing new goals and aspirations. Thousands of folks in the Moz community have met and interacted with Gillian over the last few years through her extensive world travels. I hope you'll join me in thanking her for the amazing work she's done and supporting her new, more independent direction. Plans for the Months and Years AheadThe few people I've told of this transaction before today almost always ask "what are you going to do with $20 million in the bank?!" We do have some big plans, but we also want to be very cautious and deliberate with spending. Given our revenue and expenses run rate, this is a decent amount of operating capital, but it certainly doesn't give us the freedom to be reckless. Several items on our roadmap in the next 12-18 months include:

If you have suggestions, we are, of course, all ears! My sincere thanks and great big hugs go out to everyone in the Moz community, Seattle startup world and of course, our investors, new and old. We know that the road ahead will have more big challenges to overcome, but it's been so much more fun and rewarding taking this ride together. Here's to finally putting the psychological fear and disappointment of failed funding behind us and to an incredibly bright future. p.s. If you have any questions related to this news, feel free to ask in the comments and I'll do my best to reply (am on my way to the Future of Web Insights conference in Vegas this afternoon, so please forgive if I'm a bit tardy). Sign up for The Moz Top 10, a semimonthly mailer updating you on the top ten hottest pieces of SEO news, tips, and rad links uncovered by the Moz team. Think of it as your exclusive digest of stuff you don't have time to hunt down but want to read! |

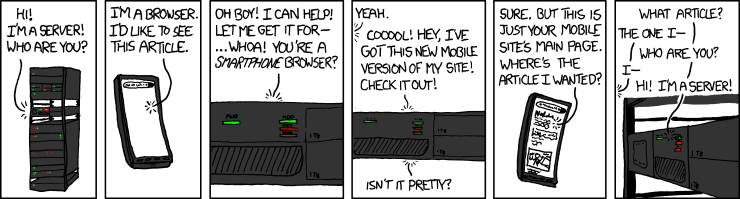

| The Real Impact of the Google SmartPhone Crawler (Part 2): Generating Mobile Redirects Properly Posted: 30 Apr 2012 08:20 AM PDT Posted by Suzzicks This post was originally in YouMoz, and was promoted to the main blog because it provides great value and interest to our community. The author's views are entirely his or her own and may not reflect the views of SEOmoz, Inc. Google’s new smartphone crawler may have made mobile SEO easier or slightly more predictable, but that is not the end of the story. This is the second in a 3 part series aimed at giving more actionable mobile SEO tips for how to understand and respond to Google’s new smartphone bot. In the last post, we covered how the new smartphone bot works, and which sites will be affected by the change. This post will focus on how to generate mobile redirects that will help the smartphone bot find and index your mobile content correctly. The next and final blog post in this mobile SEO series will review common indexing problems with mobile sites, and how to prevent them. Since the smartphone bot caches and follows mobile redirects when they are in place, the ranking of your mobile-specific pages (like ones on an ‘m.’) becomes much less important than the rankings of your desktop pages on smartphones. You can usually rely on the strong SEO and rankings of your desktop pages to make desktop pages out-rank mobile pages, even on a mobile phone, but now when a smartphone requests one of those desktop pages from a search result Google will automatically serve the mobile page instead of the desktop page. Problems enter the picture quickly when the redirection is not set up properly. Google is not being very transparent about this new bot. As of the writing of this article there are many questions on the blog post with the official announcement of the new bot, but they have all gone unanswered by Google. (Here is the official announcement from Google with unanswered comments below). What we do know, is that the smartphone bot emulates [pretends to be] a smartphone (specifically an iPhone 4.1) when it crawls your website, and thus, it follows any redirects that are in place that would be targeted at a smartphone – This redirection of visitors on smartphones to a different page is called user-agent detection and redirection. Essentially, when a page is requested from your server, the server looks to see what type of device is requesting the page. If it is a smartphone, the server sends the visitor to a different version of the page. (This is all controlled by PHP or ASP.NET code that is placed on the server, and in header of all the page templates.) Based of what we know of Google, and how they handle mobile and desktop indexing, here are some notes and speculations about how to create the proper types of mobile redirects that will most likely get indexed: Server Based Redirects - 301 & 302 In the SEO world of redirects, the 301 is King, but in mobile the 302 is a bit more common. This is because many mobile platforms generate temporary mobile pages that don’t actually exist permanently on servers anywhere, so the developers don’t want to open themselves to any risk that might be associated with a ‘permanent’ redirection. My guess is that the smartphone crawler can cache EITHER a 301 or 302 redirect but the redirect must be set to be ‘privately cachable’ in the html headers and it must go to a permanent, indexable mobile page. The likelihood of Google caching on-page JavaScript redirects is low, as is the probability of Google caching multiple versions of parameter-based redirects to dynamically generated pages, because this would all be too hard to police and waste lots of unnecessary space in their datacenters. Redirection on Every Page Like with desktop websites, you cannot always assume that mobile visitors will enter your site from the mobile home page. For the mobile redirects to be indexed properly by the smartphone crawler you will need to set up user-agent detection and redirection on every page on your site, and not just the home page. If the redirection script is missing from internal pages, the smartphone bot will not see the mobile pages, so when the listing is clicked on from a smartphone search result, the visitor will still be delivered to the desktop version of that page since there is not redirect cached. Always Page to Page Google really likes having a discrete ratio of associated pages in its index. What that means for your redirects, is that they should be from a specific page on the desktop site to the corresponding specific page on the mobile site. This assumes that the mobile version of your site is a complete mirror of your desktop site, and creates problems for mobile sites that don’t entirely mirror their desktop counterparts. If your mobile site and your desktop site are significantly different, you have to do the best that you can to associate mobile desktop pages with the mobile page that is most closely related, even if it is not an exact match. Example: A news site that does not bother adding all of its articles to the mobile site is a common situation where there is not a 1-to-1 ratio of mobile pages to desktop pages. When that is the case, your only option that is good for both users and search engines is to either have no redirect and serve the mobile visitor the desktop page, OR redirect the desktop visitor to the category page for the type of news they were looking for, with a small message inserted at the top of the page with JavaScript, to explain that the page they requested has not been mobilized – and that they can click a link to see the desktop version of the story or view other topics in that news category. If you decide simply not to include a redirect, and serve the desktop page, a simple alternative would be to add a separate mobile stylesheet to the desktop page template. With that in place, at least the desktop content will be formatted to fit on the visitors’ screen, even if it is not 100% updated to the full mobile page template. Mirrored Mobile & Desktop Urls Mirrored urls can give Google a stronger sense that the two versions of the page are closely associated, especially when serving one in place of the other, as Google’s new smartphone bot does. To create mirrored or parallel url structure between the desktop and the mobile site, you must simply replicate the file structure of the desktop site on the mobile site with the only modification being the addition of either the mobile subdomain (‘m.’) or the mobile subdirectory (…/m’) on the mobile alternatives. Example: www.yoursite.com/cindy has a mobile version of m.yoursite.com/cindy or www.yoursite.com/m/cindy, so the file structure IS mirrored or parallel. Again, this rule assumes that there is a one-to-one ratio of desktop pages to mobile pages, and that may not be the case on your site, but you should do the best you can to be consistent with the url structures and differences between your mobile and desktop pages. If your pages are already set up that way, there is a handy mobile redirection script generator to help you generate the page to page redirect rules, and it can do as many as 4 versions of a site, so desktop, smartphone, WAP and tablet in ASP.NET or PHP. iPhone-Specific Handling Since the smartphone bot is emulating an iPhone, your server will likely send it exactly what it would send to an iPhone. That means that if you are handling iPhones with specific content or a different version of the site, you should be extra careful to make it crawlable, and to make sure that it is ok to serve that content to all of the smartphones. If you have different pages for non-iPhone traffic, then you may need to set up user-agent detection and redirection on your iPhone pages, to send the other types of smartphones to the other pages, to over-ride the automatic redirection from the smartphone bot. If you are using iPhone specific advertising that is triggered by on-page JavaScript that detects the handset and shows the add (very common for on-site app advertising and promotion) then that is fine, as long as it is crawlable, and not always redirecting to one specific page. If that is the case, then you might have to consider blocking the smartphone bot, until those settings can be updated; otherwise, you may have to block the smartphone bot totally. With the lack of transparency from Google it is hard to be sure about the specific architecture and settings that will have the most positive impact on your mobile rankings and user experience. This is a basic set of rules that are considered mobile Best Practices. They are most likely recognized and understood by the new bot, and should serve you and your users well, at least until we are given more clarity and have more time to compile and evaluate the long term impact of Google’s new smartphone crawler. If you follow these rules you should be in pretty good shape for getting your mobile content indexed correctly by Google’s new smartphone bot. Stay tuned next week to find out how you can configure your servers or check the settings of your mobilization company’s servers to prevent common search engine indexing problems for your mobile content. Sign up for The Moz Top 10, a semimonthly mailer updating you on the top ten hottest pieces of SEO news, tips, and rad links uncovered by the Moz team. Think of it as your exclusive digest of stuff you don't have time to hunt down but want to read! |

| Gathering More Data: Time to Take and Share the 2012 Industry Survey Posted: 30 Apr 2012 03:55 AM PDT Posted by Erica McGillivray Because we want to gather the best data from a wider sample set, we've extended the Industry Survey deadline until Friday, May 18th. Help your fellow online marketers and take the 2012 Industry Survey today. Our biannual survey covers everything from what you've been doing to what tools you've been using and how your team is structured to what you think the future of online marketing is. This year's survey takes approximately 20 minutes to finish. For those of you who haven't seen, check out the results of what we found in 2010. But as you know, our industry moves as quickly as fingers over a keyboard, and we hope that you're as excited as we see a broader view of what's happened since then. If you're still not quite aboard, Alan Bleiweiss from Search Marketing Wisdom says some great things about why it's important to better understand what we do. "Even with the limitations such a platform has, this biennial crowd-sourced knowledge dump is by far, the single most valuable tool we in the industry have to help gauge the general state of where we as an industry are, and where opportunities might exist for efficiency and productivity, and insights and answers that we may have not given enough weight to on our own." Give yourself a 20 minute break and take the survey. At worst, you'll be sharing with your fellow marketers, and at best, you may win one of our fun prizes:  One Grand Prize Winner will get a 16GB Wifi iPad 3. Three First Prize Winners will each get a $75 ThinkGeek gift certificate. Ten Second Prize Winners will each get a $25 gift certificate to the SEOmoz Zazzle Store. To see the full sweepstakes terms and rules, go to our sweepstakes rules page. The winners will be announced by June 4th. We'd also like to thank our partners who believe in the importance of this survey, including Outspoken Media, Search Engine Land, Distilled, Hubspot, Search Engine Journal, Techipedia, AimClear, Blueglass, Marketing Pilgrim and Search Engine Watch.

All survey answers are anonymous, so your privacy will be protected. If you do enter the drawing, we will not share or abuse your email address. If you want to share out the survey via Twitter, Facebook, G+, etc., we'd be greatly appreciative. Thank you so much. You're awesome! Sign up for The Moz Top 10, a semimonthly mailer updating you on the top ten hottest pieces of SEO news, tips, and rad links uncovered by the Moz team. Think of it as your exclusive digest of stuff you don't have time to hunt down but want to read! |

| You are subscribed to email updates from SEOmoz Daily SEO Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |