Mish's Global Economic Trend Analysis |

- Reader Question Regarding "Dropping Out of the Workforce"; Implications of the Falling Participation Rate

- BLS Job Report: December Nonfarm Payrolls +103,000, November Revision +32,000, October Revision +38,000; Workforce DROPS by 260,000

- Italy The Invisible Elephant

| Posted: 07 Jan 2011 08:42 PM PST In response to BLS Job Report: December Nonfarm Payrolls +103,000, November Revision +32,000, October Revision +38,000; Workforce DROPS by 260,000, reader "Aleph" wants to know how someone drops out of the workforce. Aleph writes ... Hello MishWays of Dropping Out Hello Aleph, someone drops out of the workforce in one four general ways. 1. They stop looking for work 2. They retire 3. They go back to school full time and are unavailable for work 4. They are institutionalized (prison for example) The big numbers come from 1, 2, and 3 with #1 leading the pack. If a person wants a job, is available for a job and keeps looking for a job, that person is unemployed. I suspect most retirees, stop looking. Note that number 2 may be voluntary or involuntary. An example of an involuntary retirement is someone who wants work to work but retires because he has expired all his 99 weeks of benefits and desperately needs to start collecting social security before he goes homeless. All of this is determined by a phone survey. The BLS attempts to determine the following 1. Are you employed full time? 2. Are you employed part time? 3. Do you want a job? 4. Are you available for a job? 5. Have you looked for a job in the last four weeks?

However, the BLS does not ask those questions directly. Rather the phone interview attempts to figure the answers to those questions. How the Government Measures Unemployment Please consider How the Government Measures Unemployment There are about 60,000 households in the sample for this survey. This translates into approximately 110,000 individuals, a large sample compared to public opinion surveys which usually cover fewer than 2,000 people. The CPS sample is selected so as to be representative of the entire population of the United States.One More Exception Based on an example in the article, those out of work because of a labor dispute are considered employed even if they are looking for another job during the dispute. Finally, please note that the official unemployment rate is solely based on the household phone survey as described above. It may not bear any resemblance to the weekly unemployment claims numbers or the monthly establishment jobs report. Participation Rate, Employment Population Ratio, and Unemployment  click on chart for sharper image The above chart from The Declining Participation Rate by Calculated Risk. The falling participation rate reflects the number of people dropping out of the workforce. It is falling for two reasons. People have given up looking for a job and also because of demographics (people retiring as the boomer population ages). The predominant reason is people have stopped looking for a job. Here are my posts on Creative Destruction, referenced in the chart above. The workforce should be expanding by 100,000 to 125,000 jobs a month. Instead it is falling like a rock. This is a very deflationary event. It stops credit expansion, and it reflects retirees needing to draw down on their savings, pulling money out of the stock market. Stock market pressures are negative when people need to get out or they fear further loses in their retirement accounts. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List |

| Posted: 07 Jan 2011 10:42 AM PST Following ADP's report of private-sector employment at +297,000, the BLS reported private sector employment at +113,000 and an overall nonfarm total of +103,000 well under expectations of about +175,000 jobs. However, there were substantial backward revisions to note. Revisions

If those back revisions were instead added into today's numbers, nonfarm payrolls would be +173,000 and private sector jobs at +175,000. Those would have been good, but not amazing numbers. However, a better way of looking at things is via the revisions. We had a better than expected seasonal ramp of jobs in October followed by subpar job growth in November (even after the revisions), and subpar growth in December as well. This is along the lines that I have suggested several times: limited hiring following seasonal retail hiring. 260,000 Drop Out of Work Force The reported unemployment rate fell a substantial .4% to 9.4%. However, much of that that gain is a statistical mirage. The BLS reports a whopping 260,000 people dropped out of the work force. As a result the participation rate fell to a new low of 64.3%. BLS December Report Please consider the Bureau of Labor Statistics (BLS) December 2010 Employment Report. Bear in mind, were it not for millions of people allegedly dropping out of the labor force over the last year, the unemployment rate would be over 11% right now. Nonfarm Payroll Employment - Seasonally Adjusted Note the effect of temporary census hiring earlier this year. For all the hype about the improving economy, there has only been one good jobs report all year, in October. Establishment Data  The average workweek for all employees on private nonfarm payrolls held at 34.3 hours in December. The manufacturing workweek for all employees declined by 0.1 hour to 40.2 hours, while factory overtime remained at 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls increased by 0.1 hour to 33.6 hours.BLS Birth-Death Model Black Box For those unfamiliar with the birth/death model, monthly jobs adjustments are made by the BLS based on economic assumptions about the birth and death of businesses (not individuals). Birth Death Model Revisions 2009  click on chart for sharper image Birth Death Model Revisions 2010  click on chart for sharper image Birth-death adjustments remain in the solar system for an unprecedented four consecutive months. November was negative. I cannot recall the last negative number in any month but January or July. Birth/Death Model Methodology The big news in the BLS Birth/Death Model is the BLS is going to move to quarterly rather than annual adjustments. Effective with the release of January 2011 data on February 4, 2011, the establishment survey will begin estimating net business birth/death adjustment factors on a quarterly basis, replacing the current practice of estimating the factors annually. This will allow the establishment survey to incorporate information from the Quarterly Census of Employment and Wages into the birth/death adjustment factors as soon as it becomes available and thereby improve the factors. For more details please see Introduction of Quarterly Birth/Death Model Updates in the Establishment Survey In recent years Birth/Death methodology has been so screwed up and there have been so many revisions that it has been painful to watch. It is possible that the BLS model is now back in sync with the real world. Moreover, quarterly rather than annual adjustments can only help the process. Please note that one cannot subtract or add birth death revisions to the reported totals and get a meaningful answer. One set of numbers is seasonally adjusted the other is not. In the black box the BLS combines the two coming out with a total. The Birth Death numbers influence the overall totals but the math is not as simple as it appears and the effect is nowhere near as big as it might logically appear at first glance. Birth/Death assumptions are supposedly made according to estimates of where the BLS thinks we are in the economic cycle. Theory is one thing. Practice is clearly another as noted by numerous recent revisions. Household Data  In the last year the civilian population rose by 1,965,000. Yet the labor force rose by a mere 518,000. Those not in the labor force rose by 1,447,000. In December alone, a whopping 260,000 people dropped out of the workforce. The one bright spot in the entire report: employment rose by 297,000. Households Stats

Table A-8 Part Time Status  click on chart for sharper image There are now 8,931,000 workers whose hours may rise before those companies start hiring more workers. Table A-15 Table A-15 is where one can find a better approximation of what the unemployment rate really is.  click on chart for sharper image Grim Statistics The official unemployment rate is 9.4%. However, if you start counting all the people that want a job but gave up, all the people with part-time jobs that want a full-time job, all the people who dropped off the unemployment rolls because their unemployment benefits ran out, etc., you get a closer picture of what the unemployment rate is. That number is in the last row labeled U-6. While the "official" unemployment rate is an unacceptable 9.4%, U-6 is much higher at 16.7%. Moreover, both the official rate and U-6 would be much higher were it not for huge numbers of people dropping out of the workforce. Things are much worse than the reported numbers would have you believe. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List |

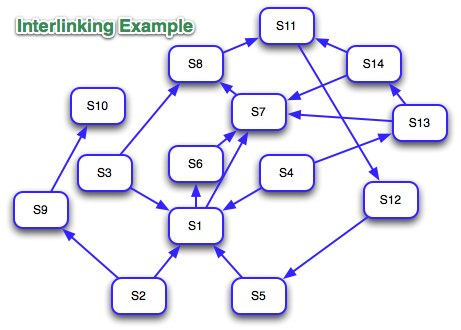

| Posted: 07 Jan 2011 04:54 AM PST In regards to the escalating sovereign debt crisis in Europe, most eyes have been focused on Greece, Ireland, Spain, and Portugal, the so-called PIGS. Dr. Evil, a former government bond trader for a very prominent bank pinged me regarding my post PIGS Exposure Table, Explaining the Panic by Numbers. Her message was to pay more attention to the second "I" in PIIGS, namely Italy, the "invisible elephant". Dr. Evil writes ...Let's take a closer look at sovereign bonds spreads in Europe, comparing German 10-year government bonds to Italian 10-year government bonds. German 10-Year Government Bonds  Italian 10-Year Government Bonds  Since mid-October, German 10-Year Government bond yields are up .64%. In the same timeframe, Italian 10-Year Government bond yields are up 1.04%. The flight-to-safety divergence increased starting around December 16, 2010. Since then, German bonds yields are off .16% while Italian bond yields rose .14%. Government Bond Spreads as of January 7, 2011 On January 7, 2011 the German-Italian spread government bond spread is 1.88% and rising. Table is courtesy of the Financial Times.  Web of Debt Here is an interesting chart courtesy of the New York Times regarding Europe's Web of Debt that helps explain the picture.  click on chart for sharper image The graphic is from May, 2010 so it's a bit dated. However, it does explain the interrelationships quite nicely. Note that Italy owes France a whopping $511 billion, 20% of the French GDP. Moreover, nearly 1/3 of Portugal's debt is held by Spain. Meanwhile Spain owes huge amounts to Germany, France, and the UK. Do you think all of that will be repaid? I don't. Critical Court Ruling Coming Up In Feb 2011 the German court gives its verdict on the constitutionality of the bail-out. Fifty academics and politicians sued the government over it. February is crunch time. For more details please see EU Commission Plans Haircuts on Bank Debt; Greek Yields Hit New Record; China Buys Spanish Debt; German Courts to Decide Bailout Constitutionality. If the German courts uphold the constitutionality of these various bailouts, the crisis is merely pushed a bit further down the road. New Irish Government Likely To Demand Haircuts In March a new Irish government will take over and it is highly likely that government questions the hundreds of billions Ireland owes German, French, and UK banks. I believe Ireland should tell the ECB and IMF to go to hell and default. For my rationale, please see To Ireland With Love. Here is the "Trojan Horse" image I used with the article.  Italian Snowball and Off-Balance Sheet Derivatives In a subsequent email, Dr. Evil elaborated on Italy's off-balance sheet debt. Hello Mish,2011 Italian Debt Issuance Inquiring minds are reading Italian Public Securities By Maturity to see how much debt Italy will need to rollover in 2011. A quick look at page 3 totals approximately 281 billion in euro debt rollovers. Assume a 5% budget deficit on a GDP of roughly 1.5 trillion euros and you end up with 281 + 75 billion or roughly 356 billion euro total debt issuance. Will the market accommodate that issuance at a good interest rate? If not, the "Invisible Elephant In The Room" will quickly make its presence known in a rather rude manner. Addendum: Flashback July 23,2006: Citigroup Haunted by Dr. Evil, Fails to Gain Governments' Trust Almost two years after Citigroup Inc. riled the dozen countries in Europe's government bond market with secret trades code-named Dr. Evil, the debacle is hurting shareholders of the world's largest financial institution.Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List |

| You are subscribed to email updates from Mish's Global Economic Trend Analysis To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |