Mish's Global Economic Trend Analysis |

- Germany France Feud Erupts Again; German Central Bank Head Blasts France

- Huge Bubble in India Home Prices Ready to Burst

- US Crude Exports to Canada Triple; Brent WTI Crude Spread Lowest in Over Two Years

- Nikkei up another 3% as Yen Breaks .99; Japanese Bonds Halted; Be Careful of What You Ask

| Germany France Feud Erupts Again; German Central Bank Head Blasts France Posted: 10 May 2013 10:29 PM PDT The simmering stew between Germany and France boiled over again this week as German Central Bank Head Blasts France. France needs more time to get its budget deficit under control. That much was made clear last Friday when the European Commission announced it was granting Paris until 2015 to bring its budget deficit below the maximum 3 percent of gross domestic product allowed by European Union rules ensuring the stability of the euro.Expect Budget Failure in 2013, in 2014, in 2015 With socialists in complete control of France, especially with Francois Hollande at the helm, do not expect France to meet its deficit targets this year, next year, or in 2015. Indeed, given that French presidential terms are 5 years in length, it may be quite some time before France shows any economic improvement at all, let alone be able to meet terms of the eurozone treaty. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

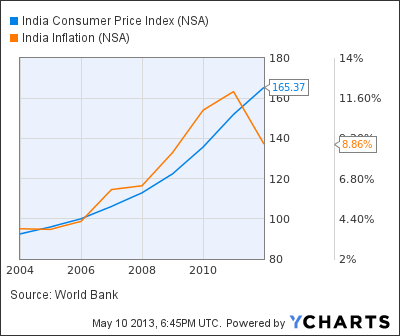

| Huge Bubble in India Home Prices Ready to Burst Posted: 10 May 2013 11:50 AM PDT Here are some interesting charts by Deepak Shenoy on the India Housing Bubble. India HPI  click on any chart for sharper image India home prices have been going up at a compound annual growth rate (CAGR) of 26% since March of 2009. Mumbai and Delhi  Shenoy reports Mumbai is growing at a CAGR of 30%, and Dehli is up 47% from a year ago and 250% since March 2009. Note the transaction volume in Delhi. Transaction volumes and prices are interesting in Bangalore and Chennai as well. Bangalore and Chennai  Shenoy has details on five other cities as well. Inquiring minds may wish to take a look. He writes "While India as a composite country is not at a bubble stage right now, it's important to note that various bubbles are building up in individual cities. If any of these bubbles worsens, then it is likely that other cities will follow. There are no un-correlated prices in a crisis." I would suggest that India as a composite certainly is in a housing bubble. The overall HPI shows just that. India Inflation  India Consumer Price Index data by YCharts Home prices have increased far more rapidly than reported inflation, which I propose is hugely understated. Inflation measures typically do not reflect actual property prices and certainly do not reflect other asset bubbles. For a discussion, please see Hugely Negative Real Interest Rates Fuel Yet Another Housing Bubble; A Word About "Inflation" and Treasury Yields. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

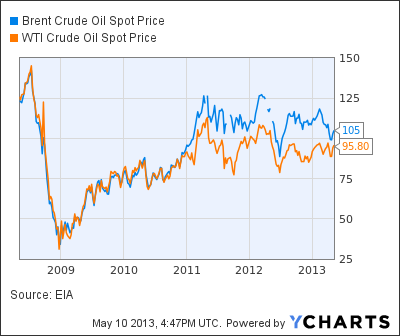

| US Crude Exports to Canada Triple; Brent WTI Crude Spread Lowest in Over Two Years Posted: 10 May 2013 10:07 AM PDT Brent vs. WTI  Brent WTI Spread  Note the drop in the spread between the US West Texas Intermediate (WTI) crude future and the Brent future, a benchmark price of European, African and Middle Eastern oil. The futures diverged sharply in late 2010 and are now converging. US Crude Exports to Canada Triple Bloomberg reports Brent Pressured by U.S. Tripling Crude to Canada. U.S. oil exports are poised to reach the highest level in 28 years as deliveries to Canada more than triple, helping bring down the price of the global benchmark Brent crude relative to U.S. grades.Does This Debunk Peak Oil? Inquiring minds may be wondering if this debunks peak oil theory. No it doesn't. Here's a quick three-point explanation.

Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

| Nikkei up another 3% as Yen Breaks .99; Japanese Bonds Halted; Be Careful of What You Ask Posted: 09 May 2013 11:07 PM PDT The Yen continued its plunge Wednesday evening (Thursday in Japan) dipping below the .99 level after having busted the 1.00 level to the downside for the first time since April 2009.  click on chart for sharper image In response, the Nikkei rose as much as 3%, now up a "modest" 375 points (2.65%) as of 1:00AM Central. Zerohedge reports Japanese Government Bonds Halted Limit Down; Yields Spike To 10 Week High; Worst Day In 5 Years. Prime Minister Shinzo Abe is playing not with matches but with dynamite with his 2% inflation mandate widely known as "Abenomics". So far, Abe's policies are popular (at least from exporters), yet I caution once again "Be Careful of What You Ask, You May Get It". There is no reason at all to believe Japan can easily contain this mess should inflation get out of hand. A mere rise in interest rates to 3% would consume Japan's entire tax revenue just on interest on its national debt. This will not end well for Japan. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

| You are subscribed to email updates from Mish's Global Economic Trend Analysis To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Niciun comentariu:

Trimiteți un comentariu